Marketing is one of the toughest parts of running a managed futures firm. It takes time, money and is often outside the skill set of most CTAs. Bryan Johnson of Johnson & Co. has spent the past five years helping and teaching fund managers about its importance and how to do it. He said CTAs may in the perfect spot right now to offer managed futures and expand their businesses.

“Marketing has become more critical than it been ever before,” said Johnson, who sat down with John Lothian News at CTA Expo New York. “There’s more noise and there are more people who are misinformed than are appropriately informed. And that’s all that marketing really is – communicating, educating and informing other people about not only your space but who you are, what your processes are and what your performance is like.”

That said, Johnson said there are a “significant number of successful, highly skilled traders who lack AUM solely because they are missing the marketing component.”

“The orientation of most is that they come to the marketing challenge and believe that marketing and fundraising are synonymous, and they’re not,” he said. “They are two separate and distinct activities. And because they believe they are synonymous, they think all they have to do is put up numbers – performance – and then the world is going to beat a path to their door. Unfortunately, that’s not the case. “

Johnson likes to say marketing to raise assets can be separated by two events – BC or before the crisis and AD, or after death or in the wake of the crisis. In BC, he said it was all about pedigree and performance. Since then, however, it’s more about a firm’s infrastructure, processes, compliance procedures and how firms are built and operate.

“Those are the things managers need to focus on when engaging and trying to raise assets – telling the believable story, making sure that story is verifiable, and that their performance, as well as the business is sustainable going forward.

For smaller firms, those under $150 million AUM, Johnson said the focus should be on the strategic, tactical and logistics of finding new customers.

“From the outset, what they should be doing from a tactical standpoint, is understanding the opportunity set that is under their feet,” he said.

For CTAs in Chicago, for example, managers should know their local market. In Chicago and around Illinois, there are around 3,600 families with a minimum net worth of $50 million. He asks, what is the CTA’s penetration of that group?

“Grow your fund organically, before you grow inquisitively,” he said. “Look at your existing investor base. And look at any existing relationships you have. Have you completely exhausted those opportunities. In most instances, they have not because they have not done the appropriate analysis of their investors. “

To Johnson, this is a great time to be in the CTA space. While equities have had a record bull run, many market watchers and economists are predicting more volatility in the coming months. Such an environment, with swift moves, provides a great opportunity for CTAs, especially those armed with the right marketing tools.

“I think this is the moment for that space,” he said.

Weekly options news recap

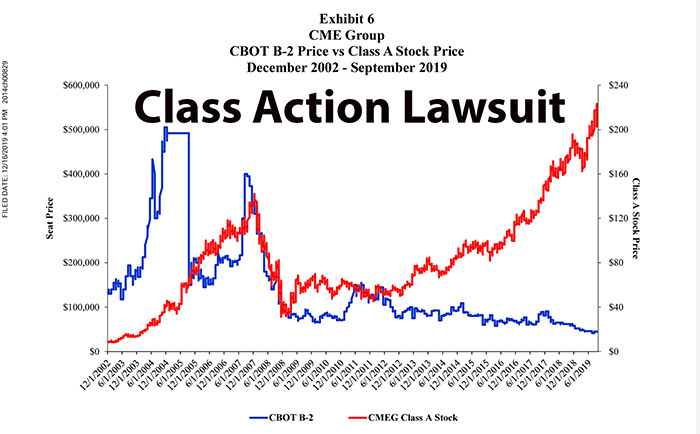

A long-standing certified class-action lawsuit against CME Group, filed by members of the Chicago Board of Trade and Chicago Mercantile Exchange, poses a potential...

In “the most uncertain times in the world,” CME Group CEO Terry Duffy does not appear to be fazed by the potential threat of...